On the Horizon: "Real Estate Bubble 2" - again risk to Financial Stability

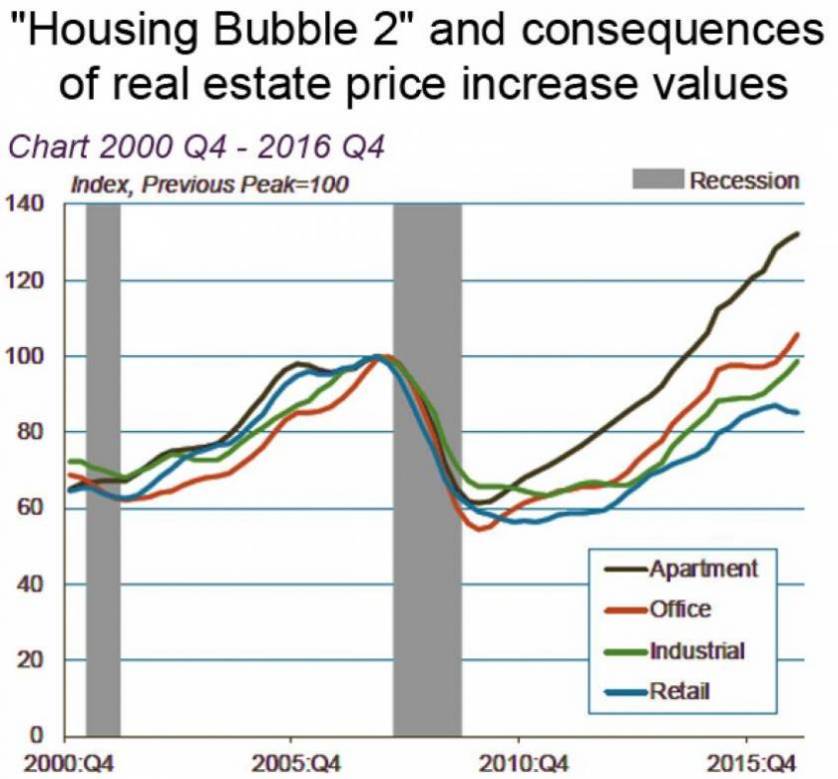

"Housing Bubble 2" and consequences of real estate price increase values.

The "Real Estate Bubble 2" is putting financial stability at risk with Fed, which caused this situation via low rates and QE. Bankers are not there to predict problems and can’t warn publicly about an approaching problem because it could trigger the very problem warning about.

In terms, real estate has a significant financial stability implication because real estate tends to be leveraged by the owners, and those loans represent a significant exposure for financial institutions that are themselves highly leveraged.

Presently the financial institutions hold near $4 trillion USD of CRE loans, including multi family residential and more than $10 trillion USD of home mortgages. This $14 trillion of real estate debt is the fondation for the triggered real estate financial crises. This why real estate bubbles, when they implode, are so pernicious.

Only in 2016, holdings of commercial mortgages by the banking sector have increased near 9 percent, while bank holdings of multifamily mortgages have increased 12 percent. This growth has occurred while bank supervisors have been cautioning about the potential risks emanating from the high valuations in some sectors of the real estate market.

The impact of the guidance from regulators over the past two years about the risks of lending to a sector in a full blown bubble has been modest, as lenders continued to support soaring prices, particularly in the apartment sector. The problem with apartments is that rental income faces the reality of maxed-out consumers and of a lot of new supply coming on the market. Even rents have soared over the past years, they have not soared nearly enough to keep up with the price increases of apartment buildings. As a consequence, cap rates have reached the lowest level since the year of 2000 (net operating income divided by the price of the property).

The steps to prevent Housing Bubble 2 is to raise rates. That significantly would stop the price increase and reverse the whole process. But rates won’t rise enough, because most likely that equilibrium interest rates may remain relatively low. Rate increases may not be enough at the equilibrium interest rate to deal with this bubble 2 as guidance hasn’t really worked so far and macroprudential tools are too limited.

The real-estate bubble 2 is once again putting financial stability at risk. But the Fed, which caused this bubble via low rates and QE, is now nudging up interest rates too slowly and too late to an "equilibrium rate" that it knows is too low. And as this bubble runs its course toward a crisizzs, the Fed will once again pretend it "Housing Bubble 1 in 2008" isn’t happening.